Unknown Facts About Bank Draft Meaning

Wiki Article

Some Of Bank Definition

Table of ContentsThe Greatest Guide To Bank DefinitionBank Account Number Can Be Fun For EveryoneThe Definitive Guide to Bank AccountHow Bank Draft Meaning can Save You Time, Stress, and Money.The Best Guide To Bank Statement

There will certainly be one number for the balance at the beginning of your statement period as well as one for the equilibrium at the end of your declaration duration. Next off, you can see the information for each individual account:. You'll see if this is a checking, cost savings, or other kind of account.

You'll see whether this is a private account or joint account you show to another person. Right here you'll see the start equilibrium in the declaration duration, the amount you got in down payments, and also the quantity you spent. You'll also see any type of passion you gained and any ATM fees you paid.

You can see each down payment and withdrawal you made during the statement duration, possibly starting with the first day of the statement duration and also progressing. Here's the information you'll see for every purchase:. You may see the name of a dining establishment or gas station where you swiped your debit card, or the name of your employer who deposited money into your account.

The Ultimate Guide To Bank Statement

This is the quantity a down payment added to your account. If you look at the last web page of your bank declaration, you'll likely see some or all of the adhering to info:.Log right into your account on a computer or phone. Click on your financial institution account name, after that look at the menu.

This means, it's saved to your gadget and also you can print the declaration if demand be. This can be an excellent option if you don't have a computer system, smart device, printer, or reputable net accessibility.

You may select to utilize your financial institution statements to take some of the adhering to actions:. By checking out your statement equilibriums and also the itemized listing of down payments and also withdrawals, you can see just how much you're spending versus saving. This may assist you produce a spending plan or readjust your financial savings contributions.

Bank Definition Can Be Fun For Everyone

Checking your monthly declarations to make certain every withdrawal is over board can be a good precaution. You may see the financial institution has actually made a blunder, or you can also understand a person else has been using your debit card information to make purchases. You might pick to conserve all your bank statements electronically or get paper copies.The rate of interests on these lendings are exactly how the banks make cash.) Reserve banks provide cash to industrial financial institutions in times of dilemma so that they do not collapse; this is why a reserve bank is called a. As well as this is one of the reasons main banks issue. At the time of the 1907 panic, the united state

Without any establishment available to offer as a lender of last hotel, the sponsor J. bank account number. P. Morgan took on this function himself and also concerned the economic system's rescue. a fantastic read The reality that one rich lender (and also some of his rich lender friends) had to bail out the economic climate developed an incentive for the government to enact bank reforms.

Federal Book System, the United States' own central bank. The Fed was developed to maintain the economic situation and also make deals smoother as well as a lot more steady.

Not known Details About Bank Statement

The Fed additionally places the dollars we utilize into circulation. The Fed wishes to keep costs secure and rising cost of living at around 2 percent, as well as it seeks optimum work. However the Fed isn't Congress and also can not make laws to regulate the economy. It acts indirectly, by changing the or the quantity of cash in the economy.

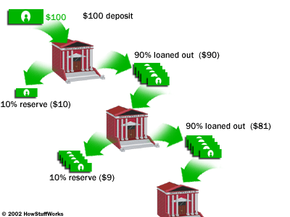

Bear in mind that individuals and corporations obtain fundings from banks? When a bank loans you money, it makes you pay interest on the money, say 5 or 10 percent of the financing amount.

e., the quantity of cash in the economic climate) enhances. The opposite is also true. The Fed likewise specifies just how recommended you read much cash business banks are called for to have on hand as well as can't loan out; establishes the passion rate that business banks pay for temporary finances from a Federal Get financial institution; and gets as well as markets securities, basically federal government IOUs.

The Greatest Guide To Bank Reconciliation

When the Fed informs banks they can keep much less cash on handeffectively allowing them to offer more moneyinterest prices decline and the money supply boosts. However if business banks are called for to keep more money on hand, rate of interest rise and also the money supply decreases. The Fed can carry out that is, use tools to reduce the cash supplywhen it wishes to reduce down the economy as well as visual rising cost of living; it takes on that is, uses devices to raise the cash supplywhen it wants to energize the economic situation as well as promote growth.Report this wiki page